Best Practices for Creating Effective Annual Reports

Annual reports offer a detailed summary of a company’s financial activities and plans over a year. This guide explains what yearly reports are, their crucial components, and how to make them impactful.

Key Takeaways

- Annual reports are essential for conveying a company’s financial status and performance and for marketing purposes, such as engaging investors.

- Key components of an effective annual report include an executive summary, consolidated financial statements, and management’s discussion and analysis, which provide a comprehensive view of the company’s operations and future direction.

- Visual elements and clear narratives enhance reader engagement and understanding, making complex financial information more accessible and relatable.

Understanding Annual Reports

Annual reports are indispensable tools for shareholders and stakeholders, providing a detailed overview of a company’s financial status and performance. These documents serve dual purposes: comprehensive financial documents and marketing tools to engage potential investors while adhering to regulatory standards. The annual report includes various sections such as operating highlights, financial statements, and management’s discussion.

Historically, the need for standardised corporate financial reporting became evident after the 1929 stock market crash, leading to the regulatory requirement for annual reports. An effective annual report offers a comprehensive company performance overview, including business activities, financial statements, and plans.

Furthermore, visual elements like graphics and photographs are often included to enhance stakeholder engagement and understanding.

Key Components of an Annual Report

An annual report comprises several key components that collectively provide a holistic view of a company’s performance and strategic direction. These essential sections include:

- Executive Summary

- Consolidated Financial Statements

- Performance Results: Each component serves a unique purpose, offering stakeholders a detailed yet understandable snapshot of the company’s operations and financial health.

In addition to these core sections, annual reports may feature a Letter to shareholders and Notes to financial statements. These additional sections provide comprehensive insights into the company’s operations and economic practices, making the report a tool for compliance and a powerful communication medium.

Executive Summary

The executive summary is a high-level overview of the annual report, designed to condense the key points into a concise and informative snapshot. This section highlights the company’s achievements, financial results, and strategic initiatives from the past year, allowing readers to grasp essential information quickly.

A well-crafted executive summary benefits stakeholders by providing a clear and engaging review of the company’s performance and future direction. Summarising key achievements and financial results allows even those who do not read the entire report to understand the company’s overall progress and plans.

Financial Statements

The financial statements section of an annual report includes critical documents that provide a clear picture of the company’s financial health. The core financial statements contained in this section are:

- The income statement details revenue, expenses, and profits over a period.

- The balance sheet provides a snapshot of assets, liabilities, and equity.

- The cash flow statement reveals how cash has been generated and used.

In addition to these core statements, the auditor’s report within the annual report provides an independent assessment of whether the audited financial statements adhere to accepted accounting principles. These financial statements reflect the company’s overall economic health and performance, offering stakeholders a comprehensive overview of its fiscal position.

Management’s Discussion and Analysis

The Management’s Discussion and Analysis (MD&A) section illuminates the company’s strategic direction, challenges, and financial context for stakeholders. This section often includes key economic metrics such as cloud revenue, Office commercial products revenue, and LinkedIn revenue, critical components in assessing the company’s performance.

Market trends and operational challenges are also crucial aspects covered in the MD&A. This section provides a platform for the CEO to communicate directly with shareholders, enhancing transparency and trust in the company’s future direction. It often highlights key achievements over the year, fostering a sense of pride and accomplishment among employees and investors.

Notes to Financial Statements

The note to financial statements plays a key role in providing clarity. It explains specific facts and figures related to the statements. These notes provide detailed explanations of line items in the financial statements, offering context and disclosures about accounting methods. They clarify accounting practices and provide the necessary context for the figures reported in the financial statements.

Including these notes ensures that all financial data is transparent and comprehensible, enabling stakeholders to make well-informed decisions based on a complete understanding of the company’s financial practices and results.

The Role of the CEO’s Letter

The CEO’s letter is a pivotal part of corporate annual reports, aiming to provide insight into the company’s performance and strategic objectives for the future. The tone of this letter sets the overall mood of the report, making financial information more relatable and engaging for readers. Including success stories and testimonials helps create a personal connection with shareholders and potential investors, emphasising the company’s achievements and aspirations.

Typically, the CEO’s letter includes:

- A summary of the company’s performance

- Major initiatives undertaken

- Challenges faced

- Future direction

This personal touch humanises the report and fosters a sense of trust and transparency between the company’s stakeholders and the company, enhancing the overall security impact that was created.

Visual Elements in Annual Reports

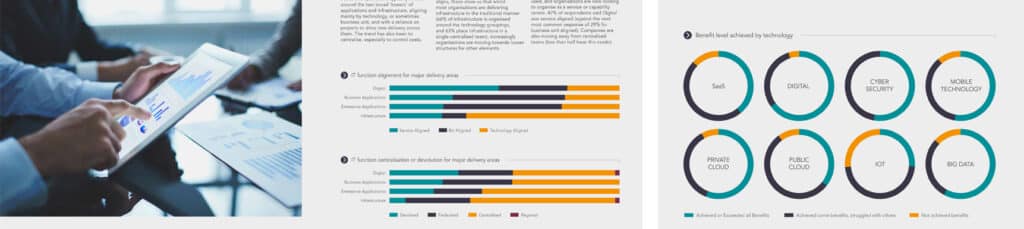

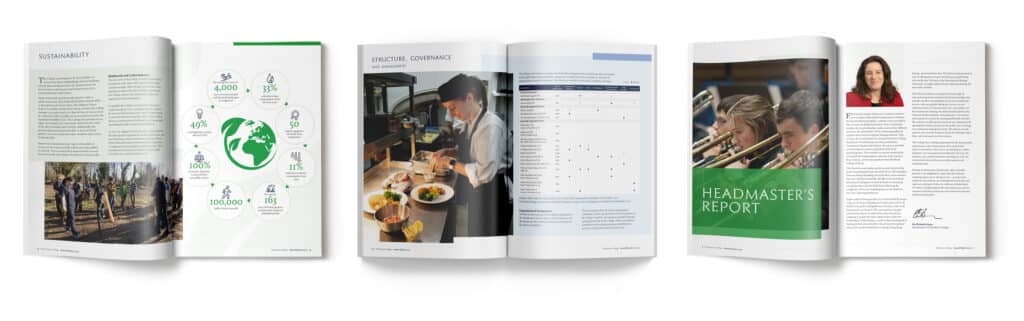

Visual elements such as narrative text, graphics, and photos are crucial in annual reports, supplementing financial data with stories and visuals. These elements enhance reader engagement and comprehension, making complex information more accessible and engaging. Professional design elements, including infographics and high-quality images, can significantly increase reader engagement.

Incorporating visual elements makes the report aesthetically pleasing and helps convey the company’s message. Infographics and charts, for example, can succinctly convey complex information that might be overwhelming in text alone. Effective use of visual aids ensures that annual reports are both informative and engaging.

Use of Graphics and Photos

Graphics, including charts and infographics, simplify complex financial data, enhancing the reader’s understanding. Visual aids like infographics and photographs humanise the annual report, making financial information more relatable. Incorporating these elements ensures that reports are informative and visually appealing.

Visuals like infographics and charts can simplify complex data, making it more digestible for readers. These elements help convey key information quickly and effectively, ensuring stakeholders can easily grasp the company’s financial health and performance.

Narrative Text and Stories

Compelling narratives in annual reports can forge a deeper connection with stakeholders by illustrating a company’s successes and future aspirations. Compelling storytelling can strengthen the connection between the company and its audience by highlighting achievements and providing context for financial figures.

Including personal accounts and testimonials in the report helps to create a deeper emotional connection with stakeholders. Narratives provide context, assisting stakeholders to grasp the underlying reasons behind the financial figures and making the company’s journey and achievements more relatable.

Compliance and Regulatory Requirements

Compliance and regulatory requirements are essential aspects of corporate annual reports. Public companies are required to make their yearly reports accessible to the public, ensuring transparency and accountability. These requirements help maintain uniformity and reliability in financial disclosures, fostering stakeholder trust.

Adhering to compliance standards is not just about meeting legal obligations; it also enhances the credibility and reliability of the annual report. These standards ensure that financial statements are accurate and transparent, providing stakeholders with a clear and trustworthy overview of the company’s financial health.

SEC Filing Requirements

Public U.S companies must file annual reports and 10-K forms to comply with SEC regulations. Key points include:

- The SEC mandates that public companies submit Form 10-K annually.

- Form 10-K includes comprehensive financial information.

- This form is a legally mandated, detailed filing.

- It must be submitted annually to the SEC.

The CEO and CFO of a company must certify the accuracy of financial information included in the annual reports on Form 10-K. This certification ensures that the financial statements are accurate and reliable, providing stakeholders with a clear and trustworthy overview of the company’s financial health.

GAAP Adherence

Annual reports must be prepared according to Generally Accepted Accounting Principles (GAAP) to guarantee transparency in financial statements. GAAP ensures that financial disclosures are uniform and reliable, consistent across companies and industries.

Auditors refer to GAAP or other relevant standards during their assessment to ensure the financial statements are accurate and transparent. Adhering to GAAP confirms that financial statements are prepared according to standardised accounting principles, providing stakeholders with a clear and consistent overview of the company’s financial health.

Differences Between Annual Reports, 10-Ks, and Proxy Statements

Understanding the differences between annual reports, 10-Ks, and proxy statements is crucial for stakeholders. While yearly reports often concentrate on a company’s narrative and visual presentation, the detailed financial disclosures in a 10-K precede regulatory compliance. Annual reports typically serve as a promotional tool aimed at shareholders, whereas 10-K filings are intended to meet SEC transparency and investor protection requirements.

Proxy statements, on the other hand, are essential for shareholders as they outline voting matters related to corporate governance, such as elections of board members and executive compensation. Each document serves a unique purpose, providing stakeholders comprehensive insights into the company’s operations and governance.

How to Access Corporate Annual Reports

Accessing corporate annual reports is relatively straightforward. These reports are often available through the investor relations section of a company’s website. Public companies must file their annual reports with the Securities and Exchange Commission, a key aspect of regulatory compliance. These reports can be accessed through the SEC’s EDGAR database, which provides comprehensive electronic filings from companies and the Exchange Commission, including securities.

Annual reports are typically available in PDF format, allowing for easy downloading and review of files. Most companies make these reports publicly available, ensuring transparency and accessibility for all stakeholders.

Tips for Creating an Effective Annual Report

Creating an effective annual report involves more than just compiling financial data. It requires clear communication, engaging design, and timely delivery. An efficient annual report communicates a company’s performance and vision while ensuring clarity and engagement.

Effective annual reports should communicate key information while maintaining an engaging narrative. Prioritising clarity, design, and timely delivery can significantly enhance reader engagement and compliance, ensuring that the report meets both regulatory standards and stakeholder expectations.

Clarity and Precision

Using straightforward language in annual reports can enhance readability for a broader audience. Avoiding technical jargon ensures the content is understandable to readers from diverse backgrounds.

Using clear and concise language ensures that annual reports are accessible to all stakeholders, regardless of their level of financial expertise. This approach not only enhances readability but also effectively communicates key information.

Engaging Design

Incorporating professional design elements can significantly increase the visual appeal of an annual report document. Engaging design is crucial to capture and maintain reader interest, making the report informative and visually pleasing.

A visually engaging report holds readers’ attention and helps convey the company’s message. Overall, engaging design enhances comprehension and retention of information, making the report more impactful.

Timely Delivery

Publishing the annual report soon after the fiscal year concludes is crucial for completing regulatory obligations and maintaining stakeholder trust. Timely delivery ensures that the report remains relevant and meets regulatory standards.

Releasing the annual report swiftly after the fiscal year concludes is crucial to keep stakeholders informed and maintain compliance. Publishing the report promptly ensures that stakeholders have access to the most current financial information.

Examples of Well-Designed Annual Reports

Well-designed annual reports stand out due to their effective use of visual elements and engaging narratives. For instance, Pencils of Promise’s report is designed for easy skimming, highlighting key statistics alongside engaging visuals. Similarly, NPR’s annual report ties in current events to demonstrate the relevance of its programming and reporting. These examples illustrate how visual elements can make complex information accessible and engaging for readers.

Another excellent example is the International Rescue Committee’s report, which uses branded colours to highlight crucial statistics, making complex online information easier to digest on the site. The report from 350.org incorporates videos to provide deeper insights into campaigns, maintaining reader engagement without excessive text.

Companies can illustrate their achievements and future potential by integrating compelling narratives and success stories within the annual report, further engaging the audience.

Summary

Creating an effective annual report requires a careful balance of clarity, design, and timely delivery. Understanding the key components of an annual report, such as the executive summary, financial statements, management’s discussion and analysis, and notes to financial statements, is crucial for providing stakeholders with a comprehensive and accurate overview of the company’s performance. The CEO’s letter plays a vital role in setting the tone and connecting with stakeholders personally.

Visual elements such as graphics, photos, and narrative text can significantly enhance the report’s engagement and readability. Adhering to compliance and regulatory requirements, such as SEC filing and GAAP adherence, ensures the report’s credibility and reliability. By following these best practices and learning from well-designed examples, companies can create annual reports that meet regulatory standards and communicate their achievements and plans to stakeholders.

Frequently Asked Questions

What is the primary purpose of an annual report?

The primary purpose of an annual report is to deliver a detailed overview of a company’s financial status and performance to shareholders and stakeholders, encompassing business activities, financial statements, and strategic plans.

What are the key components of an annual report?

The key components of an annual report are the executive summary, financial statements, management’s discussion and analysis, and notes to financial statements. Collectively, these elements provide a comprehensive overview of the organisation’s performance and future outlook.

How can visual elements improve the effectiveness of an annual report?

Visual elements significantly enhance the effectiveness of an annual report by improving reader engagement and making complex information more accessible and easier to understand. Incorporating graphics, photos, and narrative text allows for more transparent communication of key data and insights.

What are the SEC filing requirements for public companies?

Public companies must file annual reports on Form 10-K and quarterly reports on Form 10-Q with the SEC, with the CEO and CFO certifying the accuracy of the financial information. Compliance with these requirements is essential for maintaining transparency and accountability.

How can I access corporate annual reports?

Corporate annual reports can be accessed by visiting the investor relations section of the company’s website or through the SEC’s EDGAR database, which offers a complete collection of electronic filings.